Annual Percentage Rate (APR):

The interest rate you pay per year on a loan, credit card, or other lines of credit is an annual percentage rate (APR). It’s defined as a proportion of the overall balance that you have to pay.

Credit cards are a form of borrowing, and understanding the APR of a card allows you to compare deals and understand the cost of card payments. Plus, the APR helps in comparing card or loan offers and make other financial decisions. For instance, if a credit card has an APR of 10%, you might pay roughly $100 annually per $1,000 borrowed.

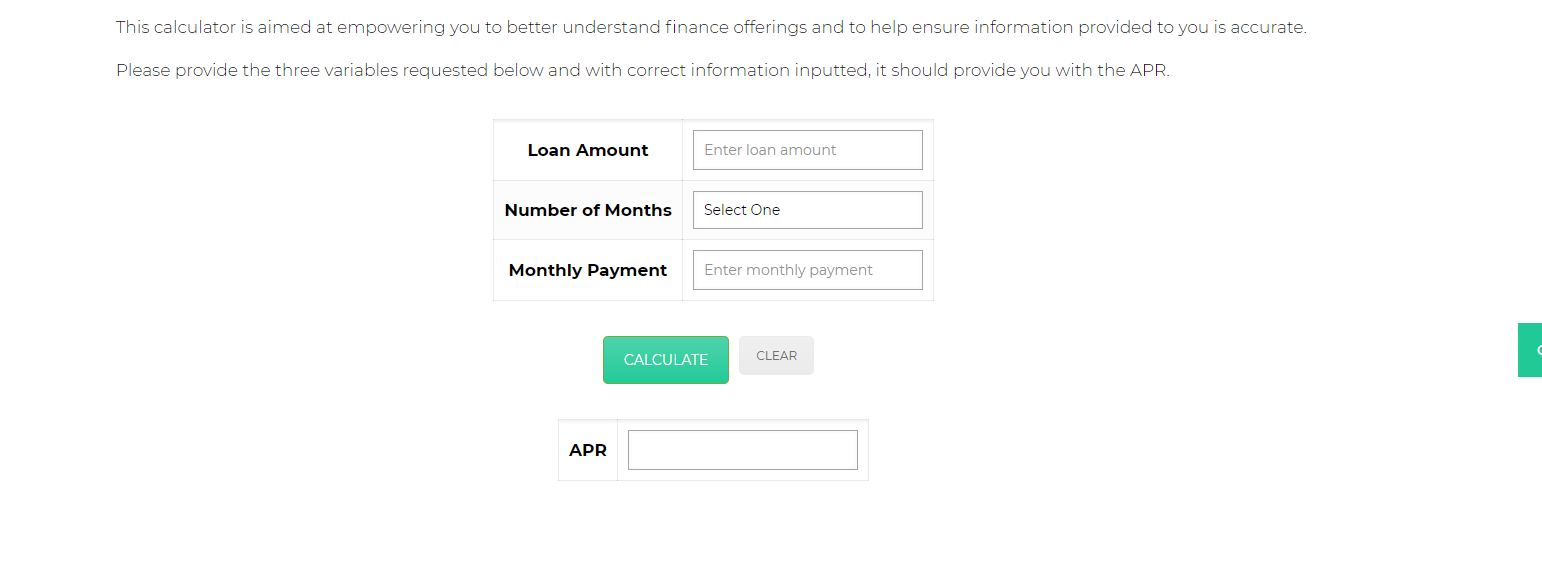

APR Calculator:

DataLime recently developed an APR Calculator that finds the effective annual percentage rate (APR) for a loan such as a mortgage, car loan, or any fixed-rate loan. The APR is the stated interest rate of the loan averaged over 12 months. Input your loan amount, the number of months, and monthly payment to find the APR for the loan.

Parameters Explained:

Loan Amount : The original principal on a new loan or the remaining principal on a current loan.

Number of Months : It is the term (number of payments) to repay the loan.

Monthly Payment : Amount to be paid each month during the term of the loan.

Conclusion:

APR, or annual percentage rate, is your interest rate stated as a yearly rate. An APR for a loan can include fees you may be charged, like origination fees. APR is important because it can give you a good idea of how much you’ll pay to take out a loan and an APR calculator helps you to calculate that factor.